Table of Contents

THE BUSTA PAGA IS AN IMPORTANT DOCUMENT THAT AN EMPLOYEE SHOULD UNDERSTAND

If you have a working contract in Italy, your employer will give you your pay slip(busta paga) at the end of the working month. You may have felt confused at the long list of information included in your pay slip(busta paga). Maybe the only thing you understand is the net salary but don’t worry, we got you covered.

This blog post will show you how to correctly read and interpret this important document, what you can do with it as well as why it is very important for every employee to understand the information it contains. Let’s see them together.

WHAT IS A PAY SLIP( BUSTA PAGA)

The pay slip is a document that the employer must provide to his worker monthly, containing the detailed information of the amount of the salary that the worker has received for the given period. With this document, the worker will be able to compare his / her salary with that agreed in the stipulated employment contract and the reference CCNL(Contratto Collettivo Nazionale Di Lavoro)

WHAT IS CONTAINED IN THE PAY SLIP( BUSTA PAGA)

The pay slip contains many important information. The most important information that pertains to the employee as regards to work includes the following:

- The number of hours worked;

- The accumulated holidays;

- Work permits;

- Contributions paid;

- Gross and Net Salary

WHY IS IT IMPORTANT TO UNDERSTAND THE PAY SLIP(BUSTA PAGA)

The pay slip(busta paga) is used to check for the correctness of the above listed information and other rights provided by your contract. For example, you can check if the salary you have received corresponds to the one decided in the contract or if the number of working hours really corresponds to the hours you worked amongst others.

You can take legal actions against your employer, in the event that there are serious anomalies within it, such as the non-payment of the agreed salary in the stipulated employment contract, and the reference CCNL(Contratto Collettivo Nazionale Di Lavoro)

WHAT CAN THE PAY SLIP(BUSTA PAGA ) BE USED FOR

The pay slip(busta paga) is such an important document to a worker in Italy, so much so that it can be useful in the following cases:

- Mutual;

- Financing;

- Employee loans;

- Work permit renewal;

- Renting an Apartment.

HOW TO READ PAY SLIP(BUSTA PAGA)

To understand how to read a pay slip(busta paga), it is important to know that there are different pay slip type that can be used by an employer. We shall be discussing the most important information that you will find in any pay slip(busta paga). However, every pay slip( busta paga) has three parts with different information allocated to each parts. The three parts includes:

- Header

- Middle Part

- Final Part

To understand how to read a pay slip(busta paga), it is important to know that there are different pay slip type that can be used by an employer. However, every pay slip( busta paga) has three parts with different information allocated to each parts.

The Header

The basic information that you will find in the header of any type of pay slip(busta paga) given by employer includes the following:

- Employer Information. Like Company Code, Business name, VAT tax code, Registered office address, Inps registration number, Inail position etc

- Worker Information. The personal data of the worker like your name, comune of resident and address, date you started working, and any termination of the relationship in the event that the contract is not for an indefinite period, type of contract, the professional qualification, the job and the level. For example: Operaio Livello 1

- Other Information. The month for which you receive the salary for example April 2022, number of days and hours you have worked. Also, there is information about base salary, fixed contingency, distinct element of remuneration, Tax deduction days, other indicators envisaged by the reference CCNL etc.

The Middle Part

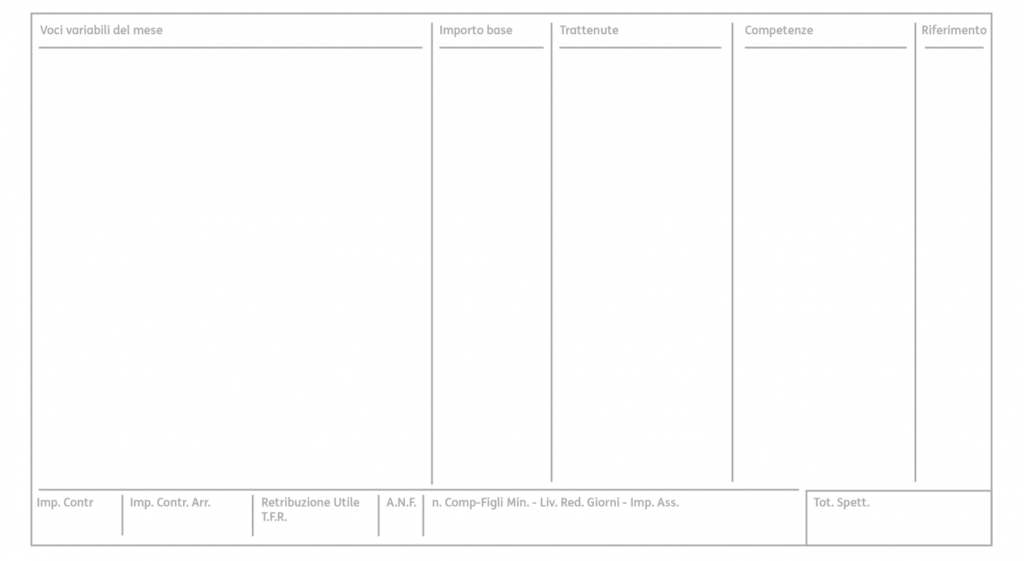

In the second section, called the middle part, the items relating to the worker’s actual remuneration are located. The items in this section can be fixed or variable. In this part of the pay slip you have five columns that indicate variables of the month(Voci variabili del mese), basic amount (Importo base), reference(riferimento), deductions(Trattenute) and fees(Competenze ).

Voci variabili del mese (Variable items of the month): In this first column, you will find the description in details of the fixed or variable items for that month. For example, the hours of work both ordinary and extraordinary hours, holiday hours that you have taken( ferie) and days off from work (malattia), holidays you have enjoyed (ferie godute),thirteenth month( tredicesima ) fourteenth month (quattordicesima), regional and municipal surcharges, TFR amount, INPS social security contributions (contributi previdenziali) etc.

Social security contributions (contributi previdenziali) is the sum of money paid to finance your future pension and other support in the event of illness, accidents at work, maternity, unemployment, etc. to which all workers are entitled.

Importo base (Basic amount): This is the second column. In this column, you will find the basic pay (or minimum pay) calculated for your salary. The cost of each work hour is usually established by law and by agreements with the reference CCNL (Contratto Collettivo Nazionale Di Lavoro)

Trattenute(Deductions): This is the third column. It contains the money that is deducted from your salary to pay taxes to the region and municipal (comune), and social security contributions to be paid to the INPS

Competenze (Fees): This is the fourth column. It contains the value of all the hours of work done, the holidays you have enjoyed, or other bonuses that are due to you.

Riferimento(Reference): This is the fifth column, in this column you will find the hours of work, ordinary and extraordinary if you have worked more, and the days of vacation for that month.

Note: Net salary is the difference between the total of your Competenze (Fees) minus all Trattenute(Deductions)

NET SALARy is the difference between the total of your Competenze (Fees) minus all Trattenute(Deductions)

Final Part

In the final part of the payslip(busta paga), you find the value of the net salary (netto del mese), that will be paid by your employer to your bank account.

There is also more detailed information about holidays (ferie) and permits accrued , the holidays enjoyed (ferie godute) and the residuals from the previous year (AP). Holiday hours accumulate every month. The total number of holidays until that month can be found under the item “Maturato” (accrued). The holidays you have taken until that month can be found under the heading “Goduto” (taken). The item “Residuo” (remaining) instead are the holidays you have left, those you still have to take.

The item “Residuo AP” indicates the holiday of the year before that you have not yet used. You will first use the remaining holidays of the previous year, and then those of the current year.

You will also find more information about Trattamento di Fine Rapporto (TFR). TFR is a small amount of money that the employer retains from the salary during the time you work in that company. It is then returned to you when the working relationship with that company ends. The amount accrued till date is shown here.

I would like to hear from you: What are your thoughts on this subject. You can share your thoughts and experiences with me and others in the comments section below!

It is hard to continue writing post like this without contributions from readers like you. If you enjoyed reading this and find it useful, please would you consider to make a donation of $2 or more, which is the price of your coffee! Your donation will help encourage and support us to continue on our work to support migrants with free educative post and trainings who can not afford subscriptions to get much needed information. Anyone can support us even YOU. Kindly support us today, it takes a few seconds, just click HERE to donate. Thank you!

SIGN UP to the MigrantDigest newsletter & receive updates & tips on news, jobs, finance, entertainment and free trainings.

PLUS, you’ll get instant free E-Book on staying in Italy legally, delivered to your email! This E-Book is guaranteed to help you to be informed of the existing rules to live a better life and to co-exist better with Italians. It only takes a few seconds!

Like this post? Don’t forget to share it!